The Process of Filing an Amended Tax Return Explained

Filing an amended tax return is essential for correcting mistakes made on your original tax filing. Whether you need to adjust income, deductions, or tax credits, an amended return ensures your taxes are filed accurately. This process is usually done through Form 1040-X, the Amended U.S. Individual Income Tax Return. Below, we will break down the steps involved, the reasons why amendments are necessary, and the key considerations before submitting your amended return.

Filing an Amended Tax Return: A Step-by-Step Guide

Steps Involved in Filing an Amended Tax Return

The first step in filing an amended tax return is gathering all necessary documentation related to your original return. This includes your initial Form 1040, any W-2s, 1099s, and supporting schedules that apply. Having these documents in hand is crucial to ensure that any corrections are made correctly.

Next, you will need to complete Form 1040-X. This form allows you to make the necessary changes and explain why the adjustments are being made. Be sure to fill out the form carefully, as errors could delay processing or result in a rejection of your amended return.

After completing the form, double-check your changes and ensure all additional forms or schedules are included. Any new documents related to the correction should be attached. Once everything is in order, submit the amended return to the IRS.

One common concern among taxpayers is, “My amended return says completed when will I receive the check?” The IRS typically processes amended returns within 8-12 weeks, but it can take longer depending on various factors. It’s important to be patient as processing times may vary, especially during peak filing seasons.

Filing an Amended Tax Return: A Step-by-Step Guide

Common Reasons for Amending a Tax Return

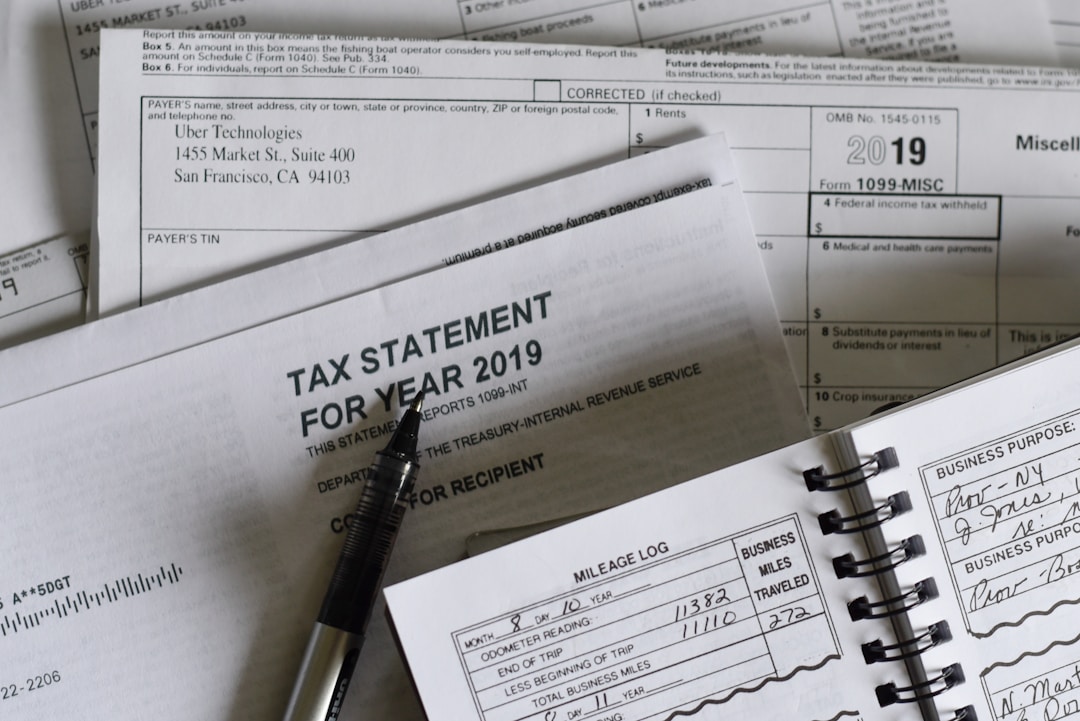

One of the most common reasons for amending a tax return is realizing you’ve overlooked income. This can happen if you receive a late or corrected form, such as a W-2 or 1099 after you’ve filed your return. Failing to include all sources of income may result in an incorrect tax liability, which can be corrected through an amended return.

Another reason to file an amended return is to adjust deductions or credits. If you forgot to claim a deduction, such as for student loan interest or missed out on credits like the Earned Income Tax Credit (EITC), an amendment can help you recover that money. It’s important to verify your eligibility for deductions or credits before filing the amendment.

Some taxpayers need to amend their returns because of mistakes in their filing status. Whether you selected the wrong filing status or need to adjust your marital status, these changes can significantly impact your tax outcome. Correcting your filing status ensures that your tax bracket and eligibility for certain credits are accurate.

You may need to file an amended return due to a mathematical error or incorrect information. Simple mistakes such as incorrect calculations or transposed numbers are common reasons for amendments. An amended return allows you to correct these issues and ensure accurate tax liability.

Filing an Amended Tax Return: A Step-by-Step Guide

Key Considerations Before Submitting an Amended Return

Ensure you have all the necessary documentation before filing an amended return. This includes any new or corrected forms and supporting evidence for your changes. Failing to include the right paperwork can delay processing your amended return.

It’s also important to note that you generally cannot file an amended return until your original return has been processed. If you filed early in the tax season, you may need to wait until the IRS has completed its review. Trying to amend too soon could result in complications or delays receiving your refund.

Another consideration is the impact of the changes on your refund or balance due. While some amendments may result in additional refunds, others may increase the taxes owed. If you owe additional taxes, be sure to submit payment along with your amended return to avoid penalties or interest charges.

Consider the potential for future audits when filing an amended return. Although amending a return is perfectly legal, large or frequent changes to your tax filings could trigger an audit. It’s advisable to keep detailed records and be prepared to support any claims made in your amended return if the IRS requests further information.

Overall, filing an amended tax return is an important step to ensure the accuracy of your tax filings and avoid potential penalties. By following the correct process and promptly addressing errors, you can maintain compliance and receive the appropriate refund or adjust your tax liability as needed.